Portfolio diversification calculator

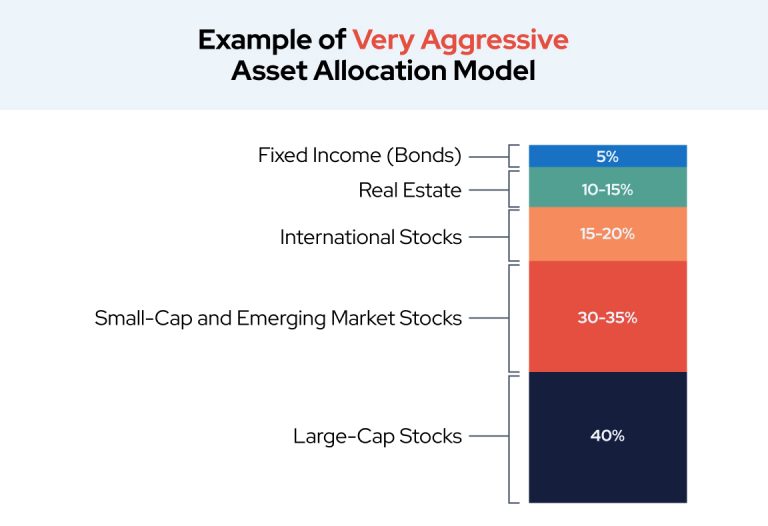

You need to enter your current age level of risk you can take from very low to very. For years many financial advisors recommended building a 6040 portfolio allocating 60 of capital to stocks.

Expected Return Of A Portfolio Formula Calculator Example Calculate Online

This portfolio backtesting tool allows you to construct one or more portfolios based on the selected mutual funds ETFs and stocks.

. Ad Manage Analyze and Handle Assets on multiple accounts. Age ability to tolerate risk and several other factors are used. It is a risk management.

Asset Allocation 100 A. Second provide either the amount invested OR the number of shares you hold in each stock - then click Add. Ad Design and present your best work in a modern and professionally designed portfolio.

Definition of Diversification. Explore the possibilities with Parametric. Explore the possibilities with Parametric.

This portfolio optimizer tool supports the following portfolio optimization strategies. Parametric helps you strengthen your client relationships. An investment portfolio is a collection of financial assets designed to reach your goals.

A diversified portfolio should have a broad mix of investments. To learn more about. Parametric helps you strengthen your client relationships.

Ad See how Invesco QQQ ETF can fit into your portfolio. The sliders in the tool can be adjusted independently to reflect the stock and bond allocations of a theoretical portfolio without diversifiers and one that includes. Build Your Future With a Firm that has 85 Years of Investment Experience.

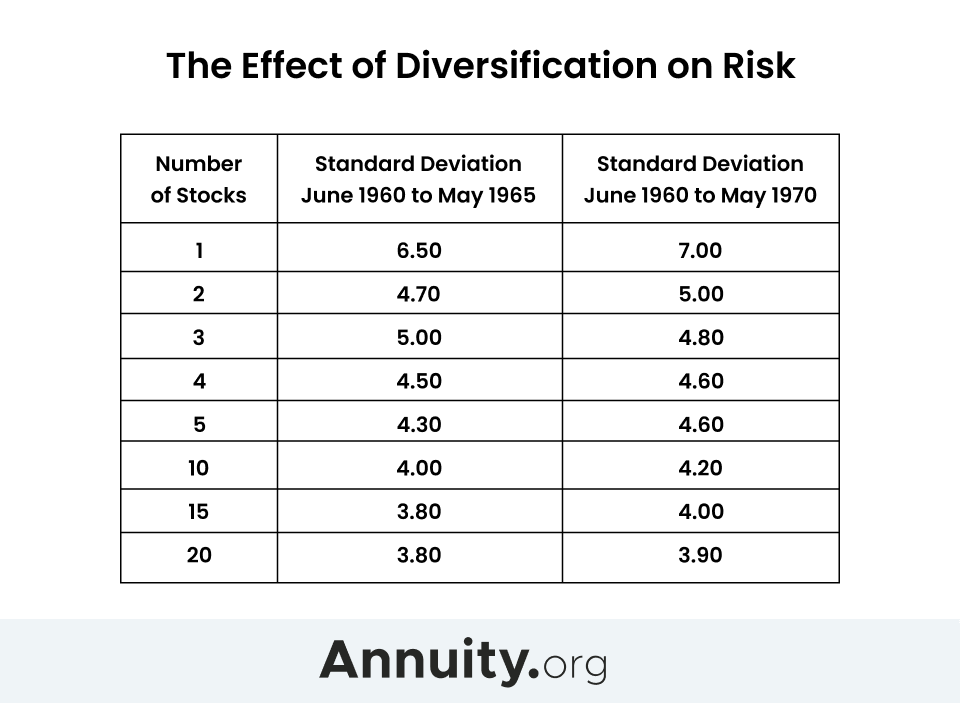

MPT shows that by combining more assets in a portfolio diversification is increased while the standard. Customizable and flexible passive investing. Ad Solve unique client needs.

If You Have Debt With PRA LLC You Have Options. Correlation is simply the. 100 35.

Managing Your Recovery Starts Here. Develop a deep understanding of your clients to provide personalized and valuable advice. Ad Make Investing Easier With A Portfolio Managed With Robo-Advice Technology.

Answer three quick questions below. Achieving Optimal Diversification to Reduce Unsystematic Risk. Per the above rule of thumb formula the allocation toward risky assets should be 65 as the time frame to invest in 30 years and the remaining.

Diversification is defined as a technique of allocating portfolio resources or capital to a mix of a wide variety of investments. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Mean Variance Optimization Find the optimal risk adjusted portfolio that lies on the efficient.

C 52 182 332 432 33 Portfolio Diversification Figure 1 Commercial Loan Portfolio. The calculation below shows that the new concentration ratio of the portfolio is 33. Diversification is a portfolio allocation strategy that aims to minimize idiosyncratic risk by holding assets that are not perfectly positively correlated.

Your Slice of the Market Done Your Way. Diversification Calculator Diversification is a technique that reduces risk by allocating investments among various fund categories. First add stock to your portfolio real or fictional by entering stock ticker symbol.

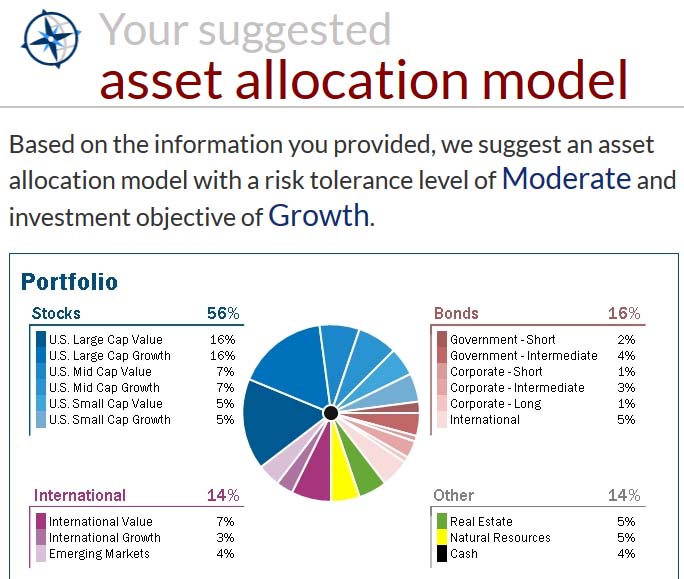

Automated Investing With Unlimited Advice From A Certified Financial Planner. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Asset Allocation Calculator is a ready-to-use tool that you can use to get an appropriate asset allocation.

The portfolio that can help you reach your goals depends on how much risk youre. You can analyze and. Diversification Calculator Wealth Management Through Diversification We diversify investment portfolios in markets and industries across the world Try Our Diversifier Our Diversification.

Ad Solve unique client needs. By combining our equity underlying hedge and income components we believe the DRS is a better way of implementing a truly diversified strategy. Choose your favorite portfolio design customize it entirely with our online design tool.

Backtest Portfolio Asset Allocation. Ad If You Have A Debt With Us View Account Information Online Payment Options At PRApay. Customizable and flexible passive investing.

Create a balanced portfolio The Asset Allocation Calculator is designed to help create a balanced portfolio of investments.

Investment Allocation And Diversification Calculator Kocaa

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-04_2-dbcdce95e61347e5bdd2df3bfabb4023.png)

How To Achieve Optimal Asset Allocation

The Proper Asset Allocation Of Stocks And Bonds By Age

What Is Asset Allocation How Is It Important In Investing

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

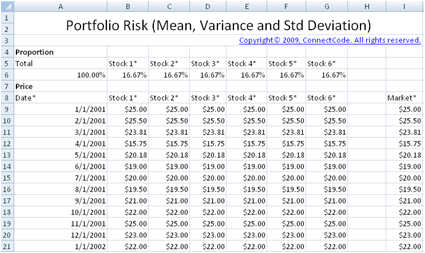

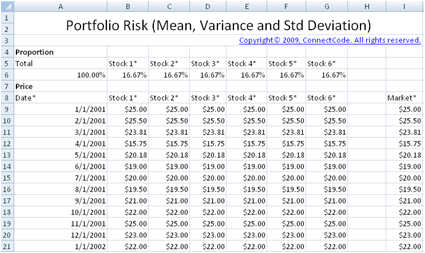

Free Modern Portfolio Risk Mean Variance Standard Deviation Covariance Beta And Correlation

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Asset Allocation The Ultimate Guide For 2021

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Do It Yourself How To Invest Your Money

Asset Allocation Calculator Cnn Learning How To Invest Money

Asset Allocation The Ultimate Guide For 2021

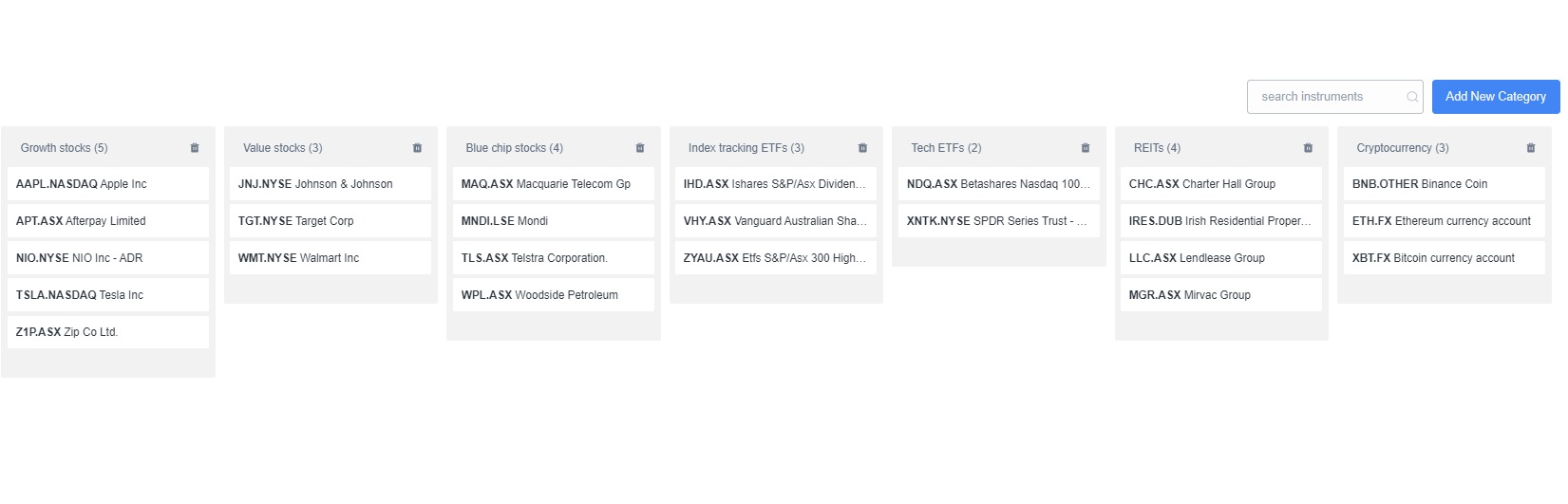

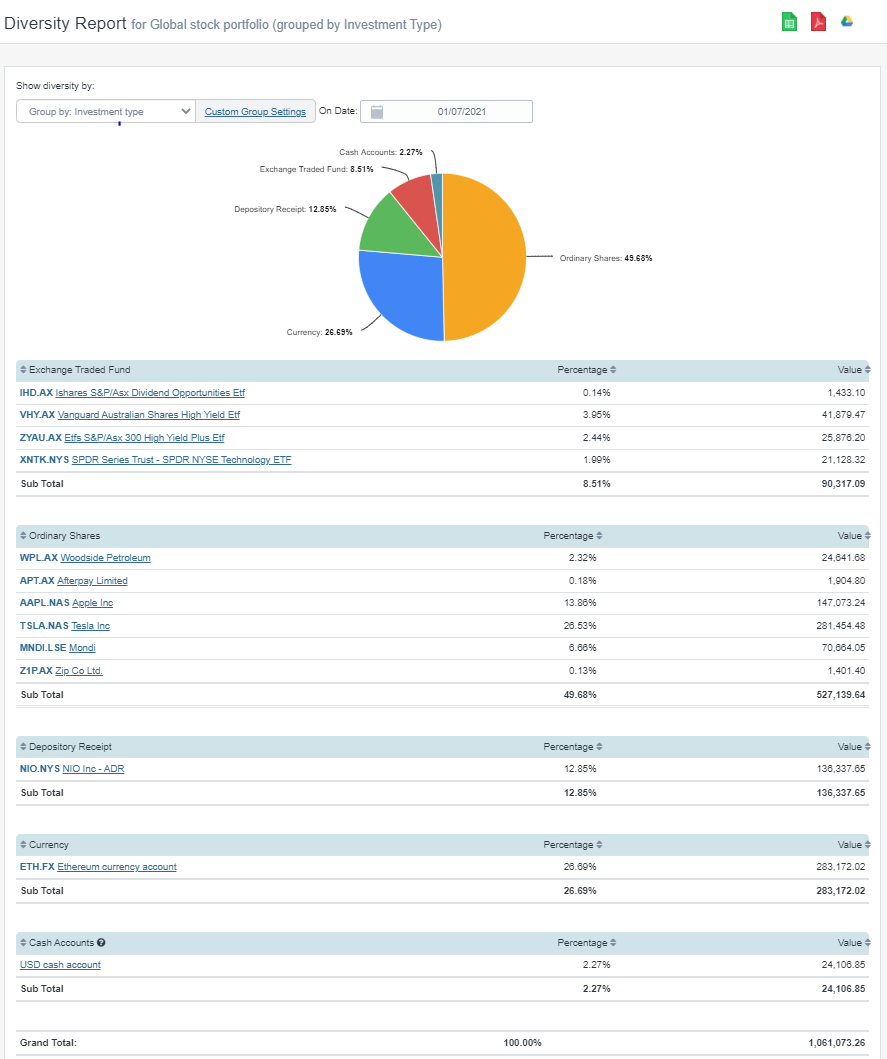

Calculate Your Investment Portfolio Diversification With Sharesight

Calculate Your Investment Portfolio Diversification With Sharesight

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Calculate Your Investment Portfolio Diversification With Sharesight

Diversification How To Build A Diversified Portfolio